Description

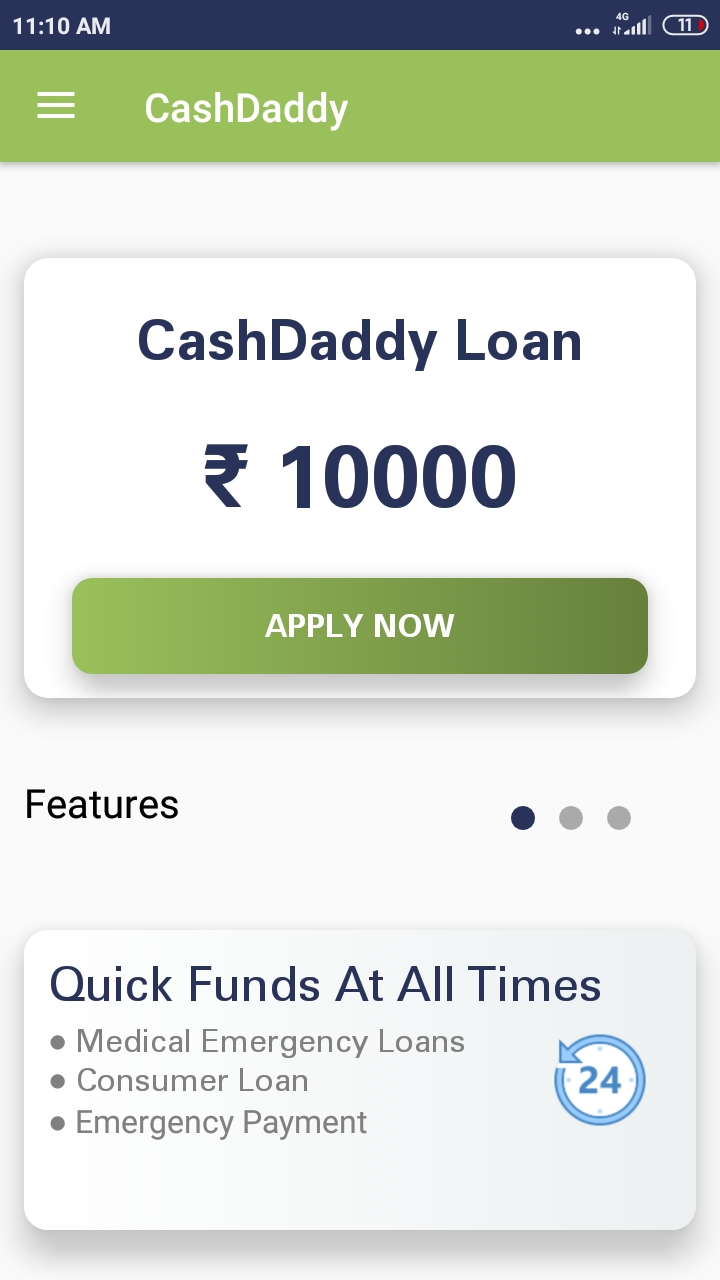

CashDaddy is a Personal Loan app which is aimed towards fulfilling the aspiration and dreams of millions.

CashDaddy is a cutting-edge FinTech product and primarily a mobile-based platform. It's been developed and designed to made make individual’s personal financing needs super-easy and faster to fulfil.

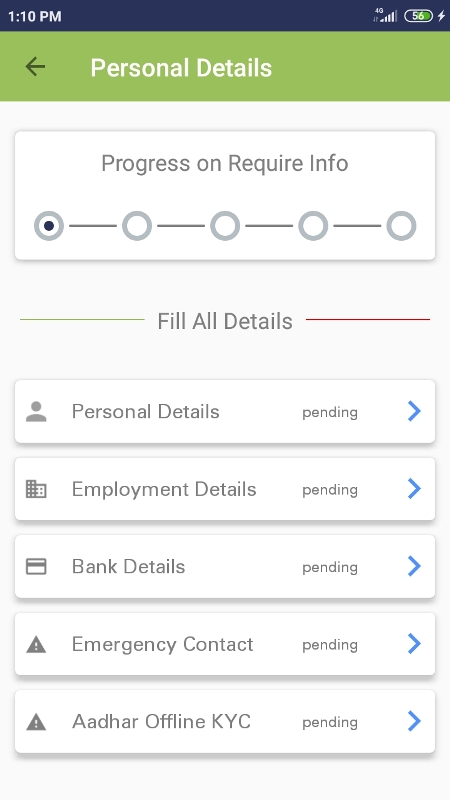

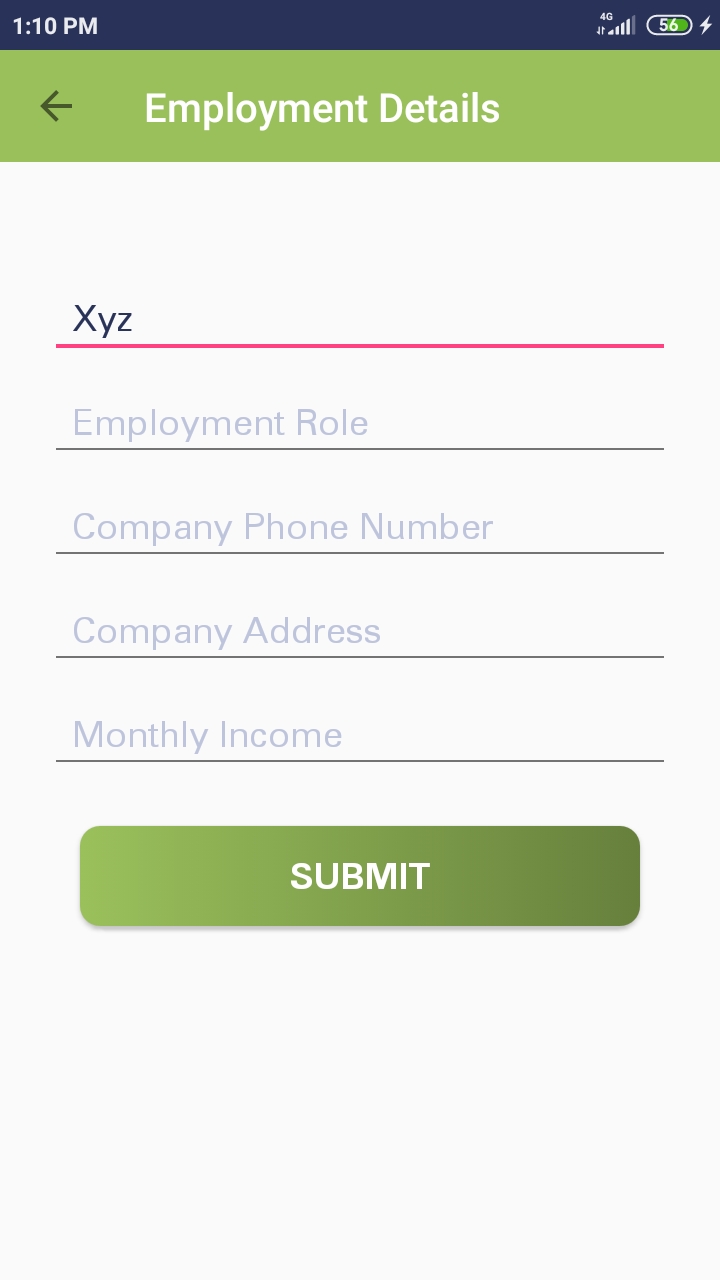

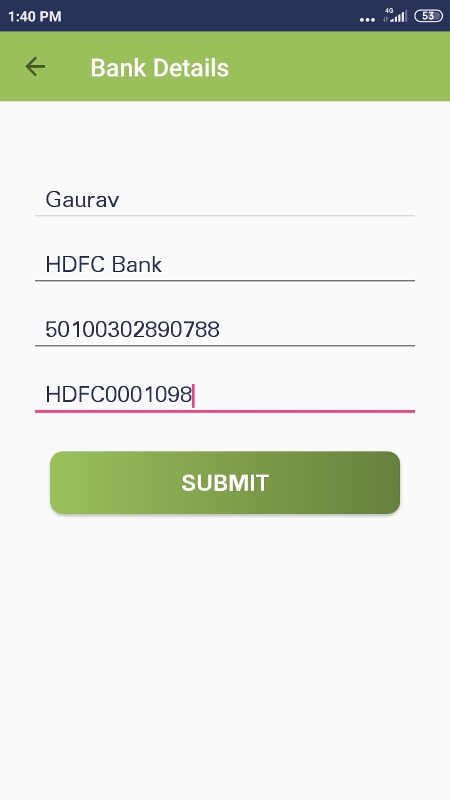

Our customers don't need to visit a branch or call anyone meet their financing needs. They just need to apply online on our mobile App, a Tech-driven system. It enables our customers to quickly get a loan within minutes without any paperwork & hurdles. Your loan application process, sanction and subsequent disbursal are all completely digitised.

Basic features of the loan will be as below:

• Loan range would be INR 1,000 to INR 50,000,

• Tenure ranging upto 90 days,

• ROI would be approximately flat 3% Per month & PF would be approximately flat 2.5% per month depending on tenure & Credit Worthiness of the Borrower.

• Repayment would be in multiple equated monthly instalments depending on the loan tenure.

This app does borrower’s credit-worthiness analysis & create eligibility ONLY basis mobile-data. SMS, Contact list, location data, Browsing history and other user's mobile phone data are far more than the Core functionality of the app as the entire analysis is based on these data points from the phone. Moreover we won't be taking any other additional document physically or otherwise from the customer.

Leveraging mobile phone data we intend to do loans in the fastest possible time. This mobile data based lending would be typically be based on very basic and minimum documentation which would happen digitally.

Customer eligibility would be based on following digitally fetched data:

• Credit bureau report,

• Non-Individual/ Non-personal SMSs: We have designed hi-tech SMS Analytics systems to butts customer banking & financial behavior from the SMS. Our system would do real time/ virtually create Customer’s banking behavior, Unsecured borrowing behavior, digital financial behavior and understand financial discipline.

• Location data: Location Analytics would determine Customer’s current location. Further it would help in understanding customer’s profile more accurately. This would also bring in more certainty in home, office addresses and business locations. This would also help in fraud prevention,

• Technical information, including Customer’s email addresses, type of mobile device Customer use, Unique device identifiers (e.g. Customer’s Device's IMEI or serial number), information about the SIM card used by the Device, mobile network information, Customer’s device operating system,,

• Browsing data Would help in understanding personal behaviour side of the behavior

• Mobile applications names/ category Would help in assessing the customer behavioral patterns. This will also help in understanding the current loan needs of the customer,

• Daily Battery usage is another indicator of personal behavior. We feel there is always some kind of messiness in being a human,

• Contact list: As a part of the loan journey, we require references from the applicant for internal record keeping. This will in auto-filling the data during the loan application process. This will also enable us to detect credible references. We won’t be using Customer’s Contact list for any other purpose other than the reasons related to the loan nor this would be shared with any third-party in any manner. Customer’s Contact list is a confidential information for us.

All the above collected information will also be internally consumed for the purpose of our enhancing proprietary machine-learning based loan risk-analysis and to accurately determine Customer’s loan eligibility and loan pricing.

Related Apps + Games

View All-

StyleBook - Online Seat Book

by Stylebook

-

Ignito – The Learning App

by Ignito

-

Drag racing - Top speed supercar

by Knine.Dev

-

Arctic Wolf Family Simulator

by ting bing