Description

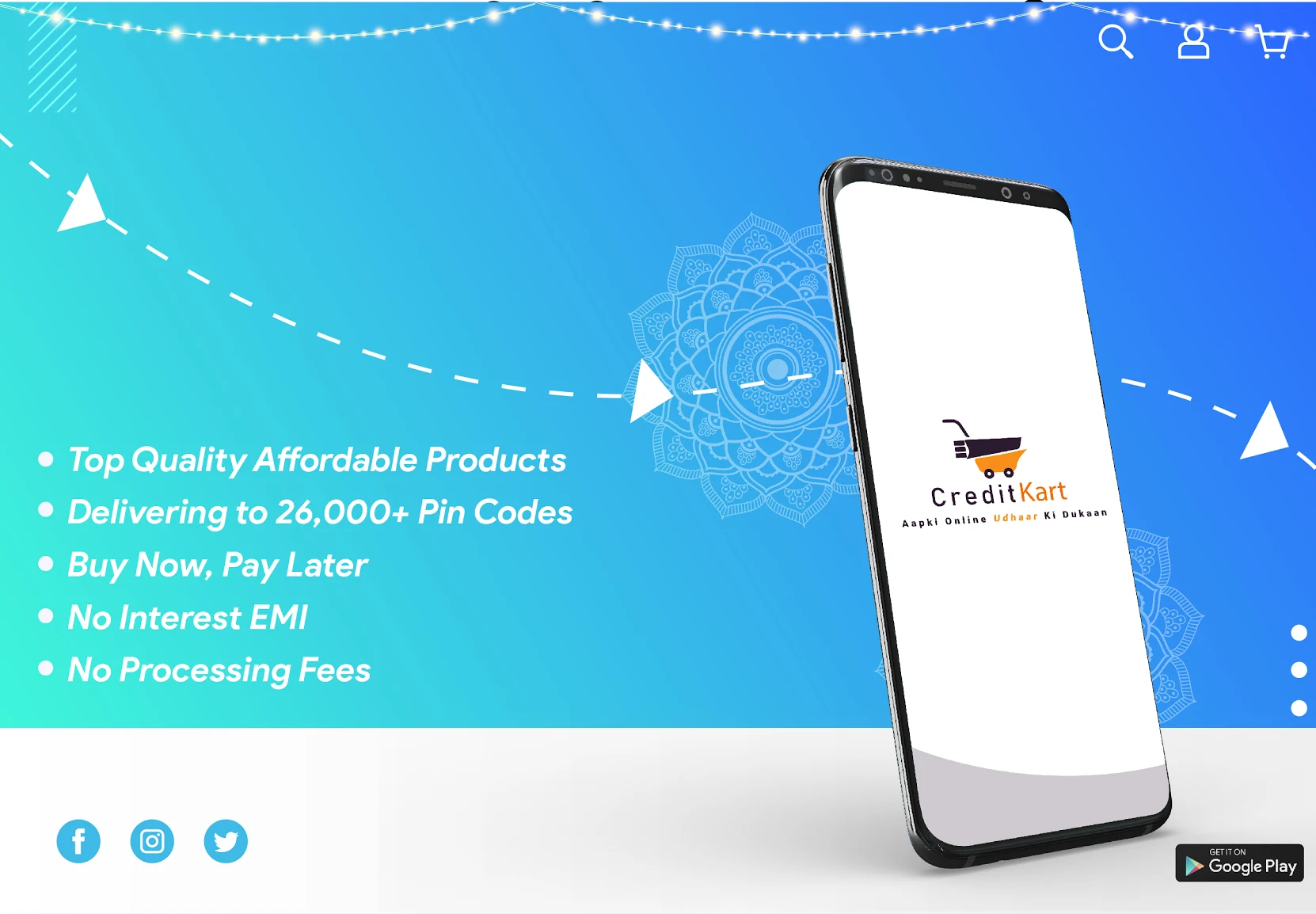

CreditKart is a shopping platform revolutionizing online shopping by introducing shoppers to a shopping experience like never before. Selling a variety of top quality products at very affordable prices, CreditKart assigns the shoppers a direct credit line and enables them “Buy Now, Pay Later”. From fashion to skincare and home decor to gadgets, we deliver happiness, Pan India over 25,000 Pin Codes.

CreditKart Features

• Get a direct credit line assigned instantly

• Repayment in 3 consecutive EMI’s

• Shop the best quality Affordable Products

• Delivering upto 25,000 Pin Codes

• No Processing Fees

• No Interest Charge

• No Down Payment or Upfront Fees

Categories Available

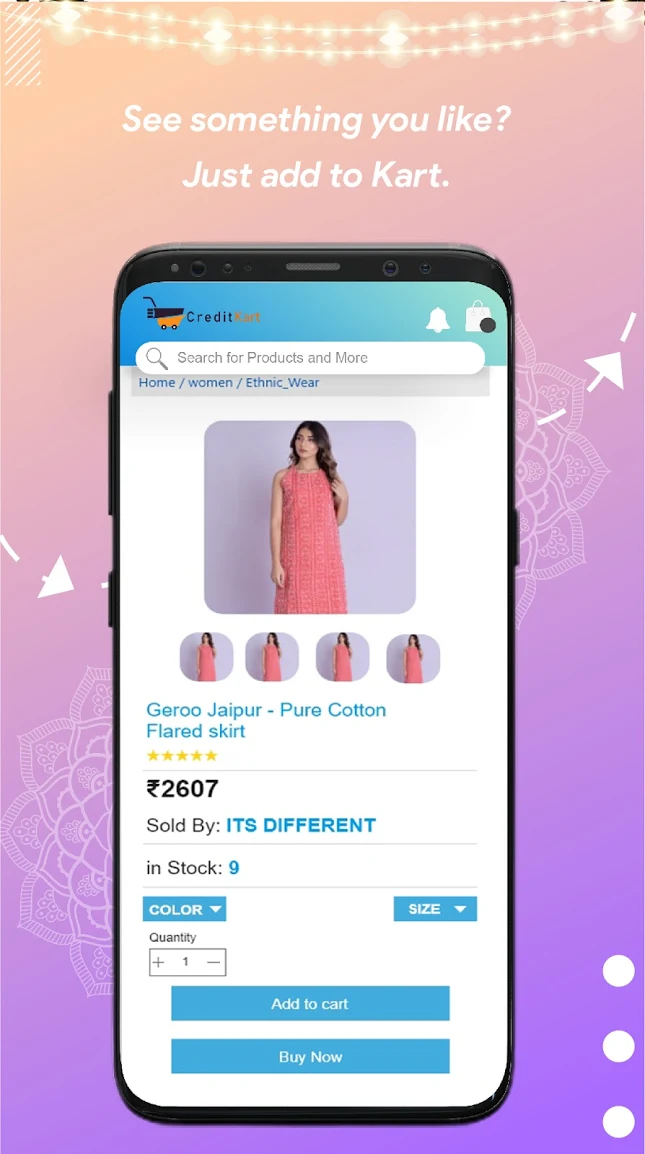

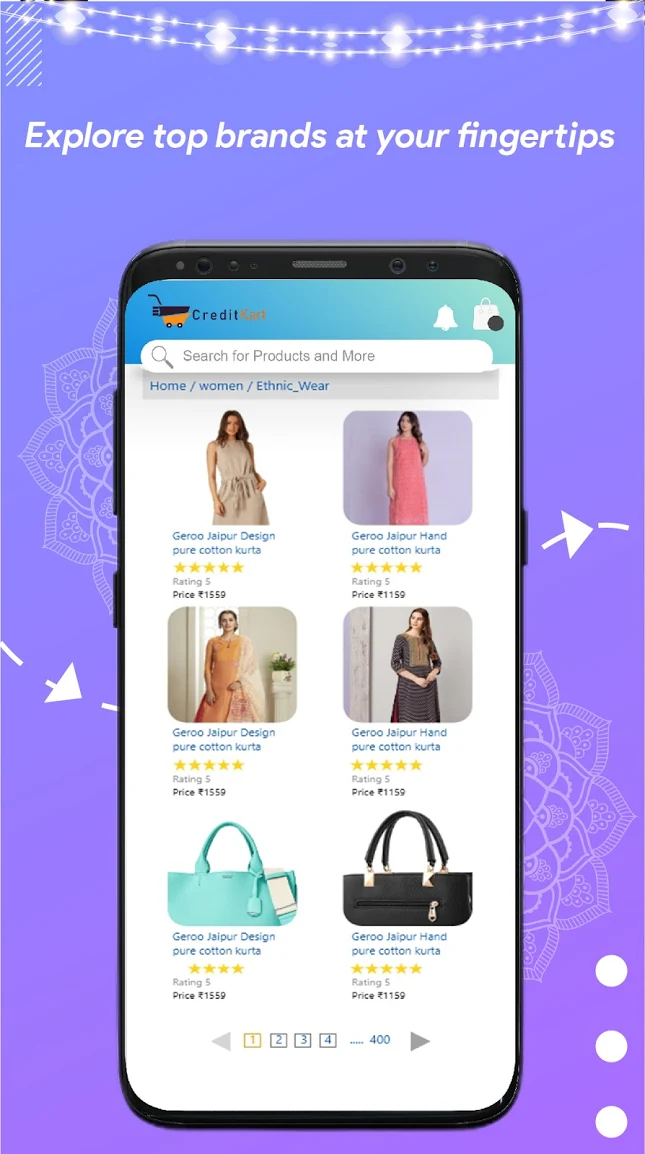

• Fashion and Accessories

• Makeup and Skincare

• Tech and Gadgets

• Home Appliances and Décor

Loan Details -

Loan Amount: From ₹ 1,000 to 5,00,000.

Minimum Period of Repayment – 90 Days

Maximum Period of Repayment – 500 Days

Maximum Annual Percentage Rate (APR) - The maximum interest rate is 20 % per annum.

Processing Fee: 5% of the loan amount

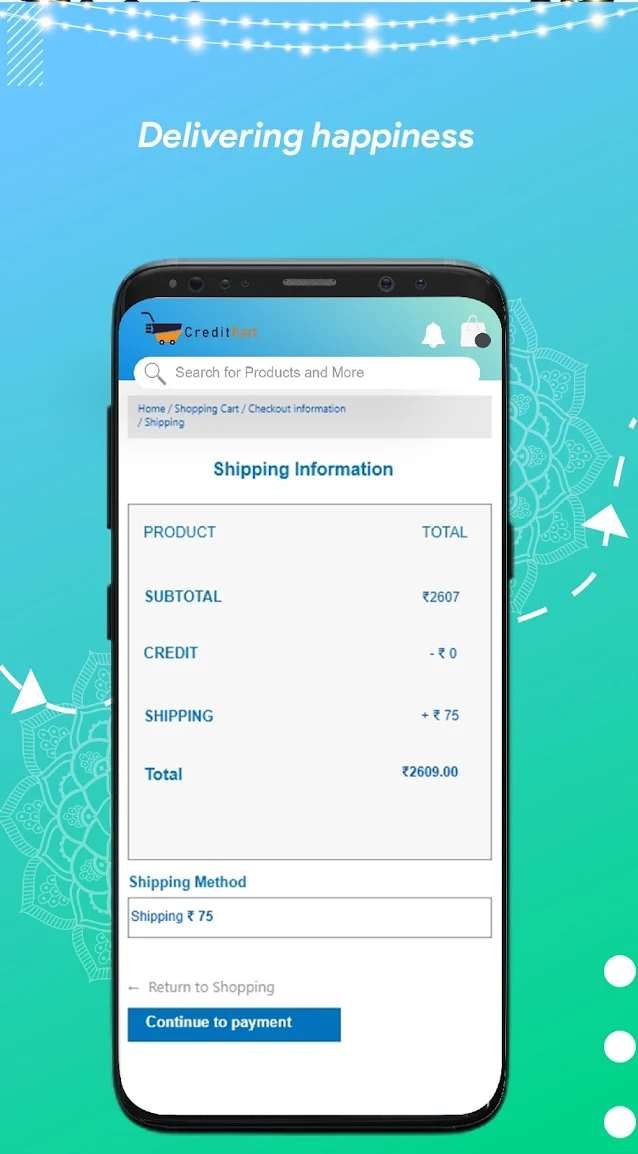

Sample Calculation.

Loan Amount :- Rs. 50,000

Processing Fees :- Rs. 2500 (INCLUSIVE OF GST)

Tenure – 3 Months

Interest Rate - 20% P.A.

Interest Amount :- Rs. 2,500

Amount will be disbursed Rs. 45,000

Each EMI will cost – Rs. 16,667

Total Repayment Amount will be Rs. 16,667 * 3 = Rs. 50,000

Description of sample calculation:-

A customer avails a personal loan of ₹50,000 at an interest of 20% per annum, where the processing fee is 2500 ( including GST ) for a period of 3 months, would end up paying ₹50,000 after 3 months. His monthly EMI would be ₹16,667.

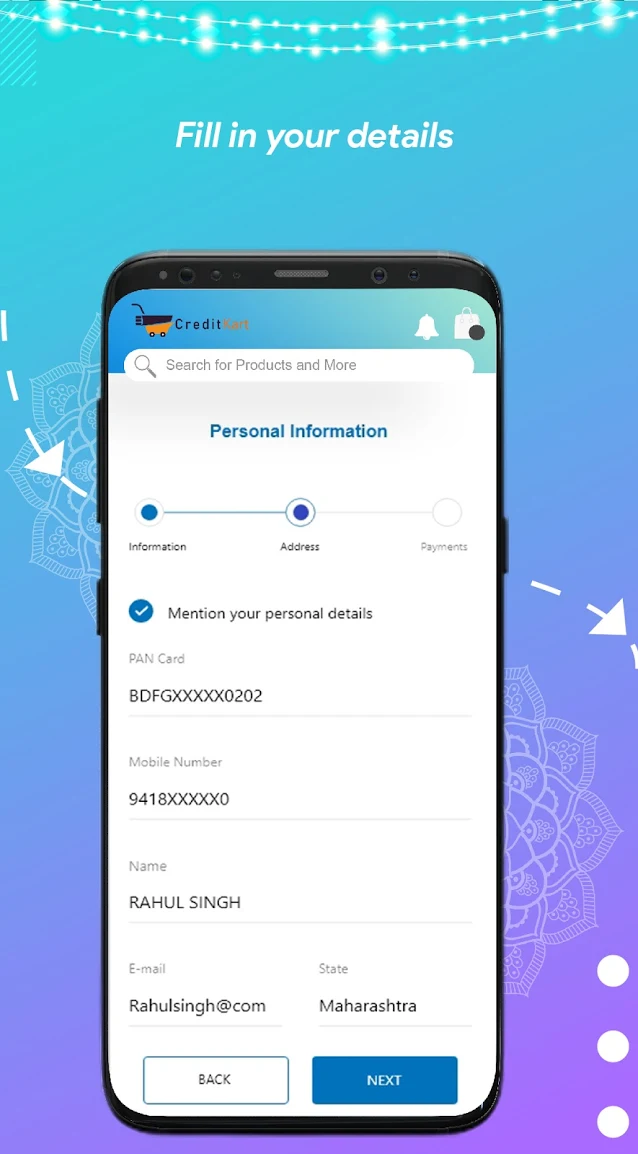

How it works?

• Download the app.

• Register an account.

• Upload a few documents.

• Get a direct credit line instantly and browse through a variety of products.

• Buy now, Pay Later!

Related Apps + Games

View All-

Logo Quiz Pro

by BonbonstudioVN

-

Droid Machine 2

by Mobiman

-

Horse Jumping Adventure

by Sezapp

-

A·Browser:Smiple,Video download

by SleepyCoder