Description

<meta charset="utf-8" /></p>

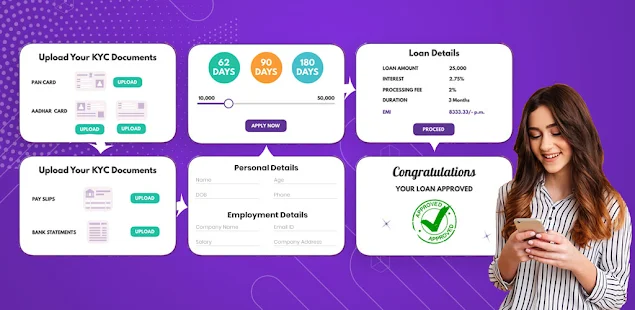

Ecofin is mobile-based lending that facilitates personal loan application, verification, & disbursement of loan digitally.

Ecofin Instant Loan Plans –

Ecofin loan products are designed to give you the convenience of selecting the most appropriate plan with instant personal loan app for salaried employee salary as a basic-criteria.

Our 3 Short-term Personal Loan Plans for the salaried employees are -

Personal Loan Plan 1: Tenure 62 days: 3% interest for 31days (35.32% p.a.)

Personal Loan Plan 2: Tenure 90 days: 2.75% interest for 30 days (33.46% p.a.)

Personal Loan Plan 3: Tenure 180 days: 2.5% interest for 30 days (30.42% p.a.)

The customers can avail loan between ₹ 10,000 to ₹ 50,000 based on their net salary.

All the plans attract a Processing Fee of 2% + 18% GST.

Eligibility to apply for the quick loan on Ecofin app –

Indian citizen

21yrs to 50yrs. of age

Salaried employee earning a min net salary of ₹20,000 p.m.

Salary crediting to the bank directly

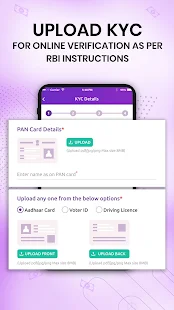

Document required to apply for a loan –

PAN card

Permanent Address Proof – Aadhar Card/ Voter’s Identity Card or Utility Bills i.e., Electric/landline phone bill (not more than 2 months old)

For Temporary Address - Bank Statement, Utility Bill, Rent Receipt, Property Tax, and Leave & License Agreement.

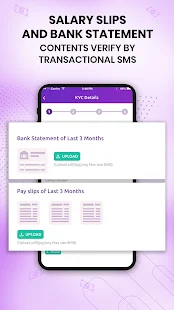

Latest salary-slip from the same employer

Latest statement of your Bank Account, reflecting salary credit for the last 3 months

Your selfie

Key features of the Ecofin app

3 loan products for the requirements of the salaried sector

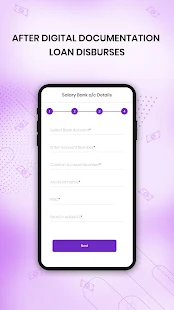

100% Paperless personal loan application, approval, and disbursement

In-app and online communication

Loan amount transferred to your bank account

Flexible short-term loans to select based on your convenience

Processing fee as low as 2% only

Loan eligibility verified within the app

No guarantees or collaterals needed

Easy EMI repayment through various payment modes

How can you make good use of Ecofin loans?

As a salaried professional, your earning will be limited and many-a-times you may need small funds to meet unforeseen expenses. Ecofin instant loans help you in attending to these emergencies or unplanned expenses. The short-term loan can be used for various personal purposes like furniture or car repair, holiday, medical emergencies, repaying credit card, etc. The interest rates are affordable with easy EMI, and you can select the tenure as per your convenience.

Related Apps + Games

View All-

Featured

Learn To Master Drums

by Learn To Master

-

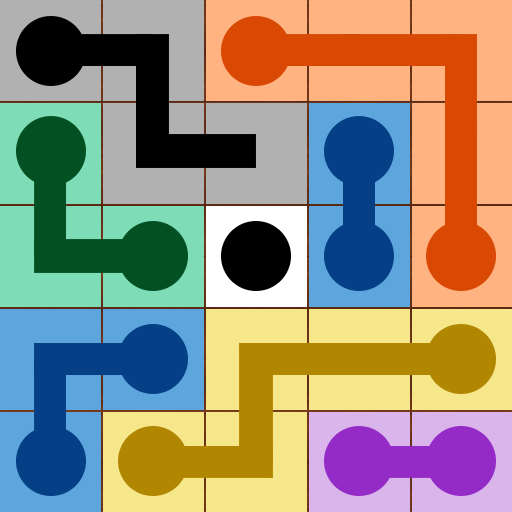

Dot Connect - Line Puzzle Game

by GameBug

-

Max Axe

by Naked Sky Entertainment

-

Green Butterfly Flower LWP

by ram