Description

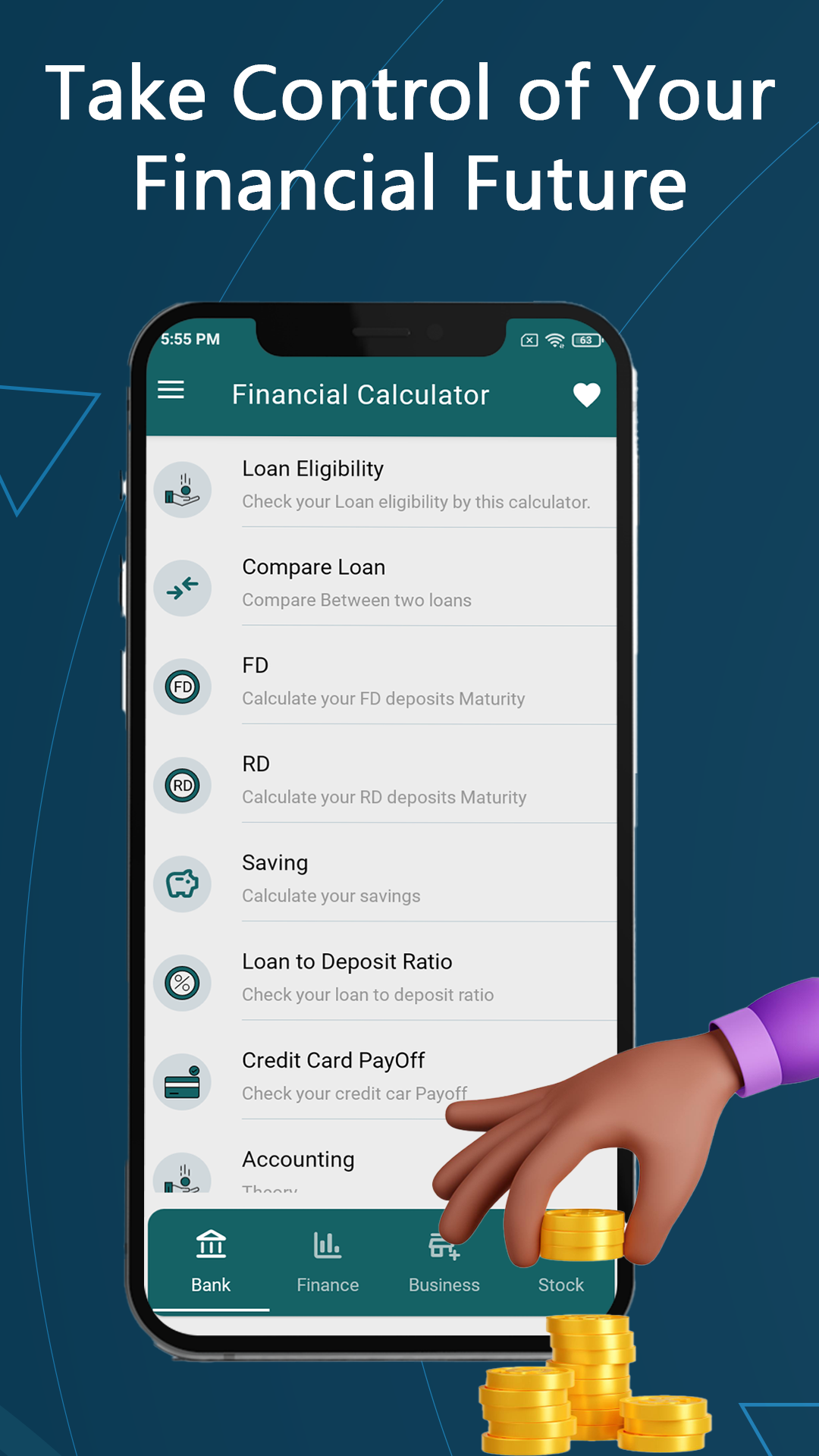

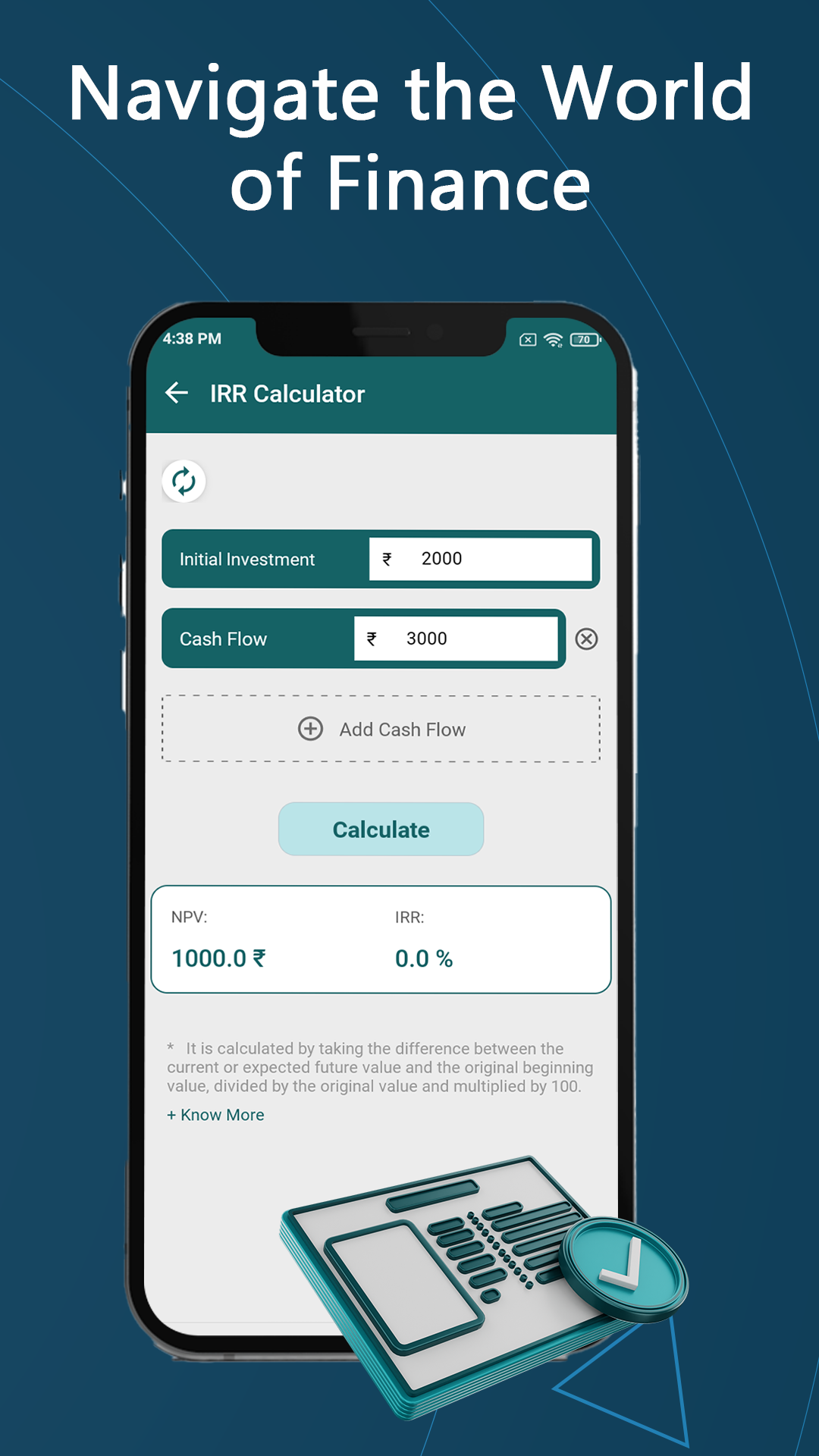

Financial calculator apps are a great way to help you make informed financial decisions. They can be used to calculate a variety of financial metrics, such as:

- Simple interest: The amount of interest earned on a loan or investment over a period of time.

- Compound interest: The amount of interest earned on an investment that is calculated on both the principal and the interest that has already been earned.

- Loan amortization: The process of paying off a loan over time, including the calculation of monthly payments and interest.

- Retirement planning: The calculation of how much money you need to save for retirement and how long your money will last.

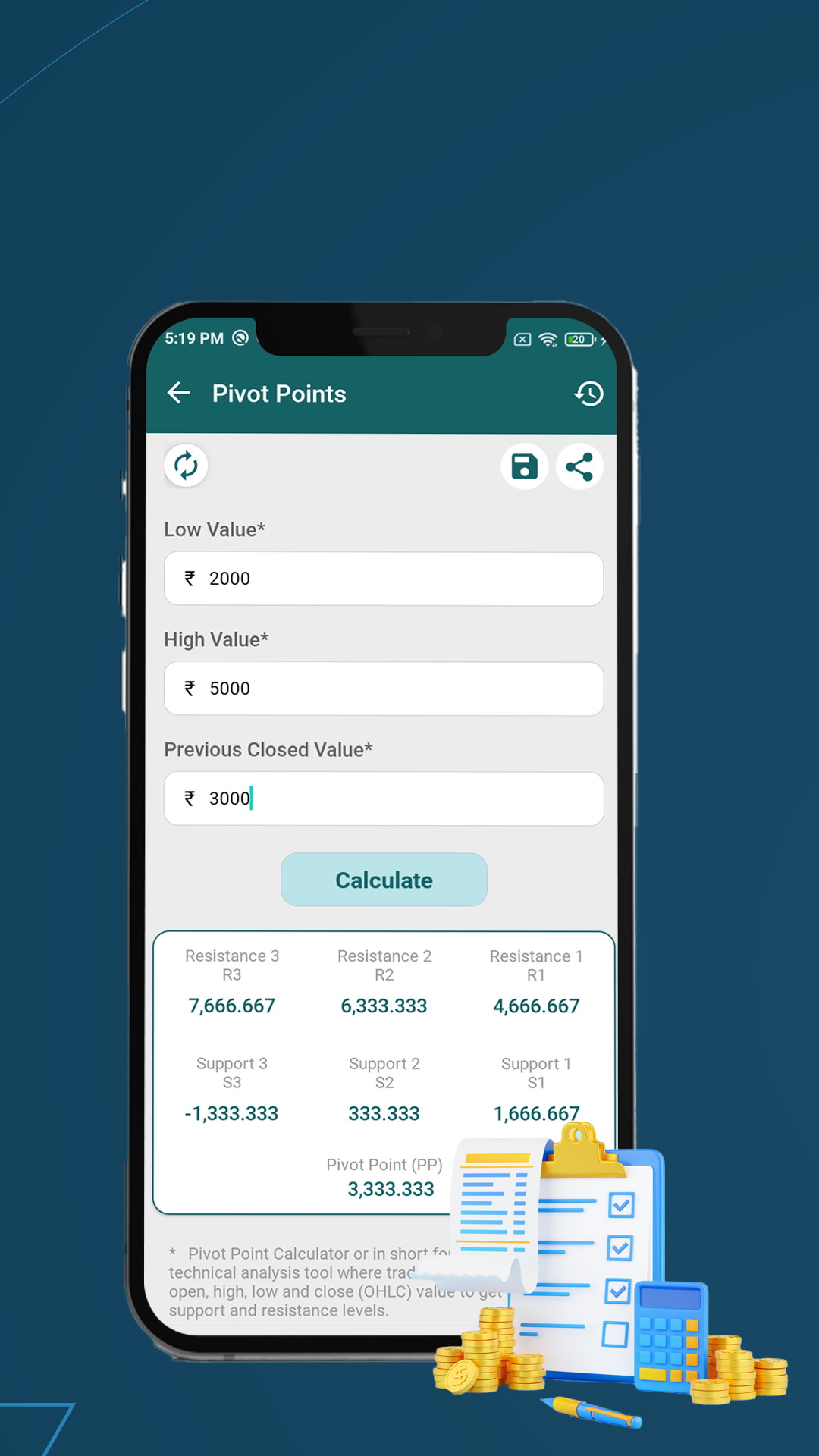

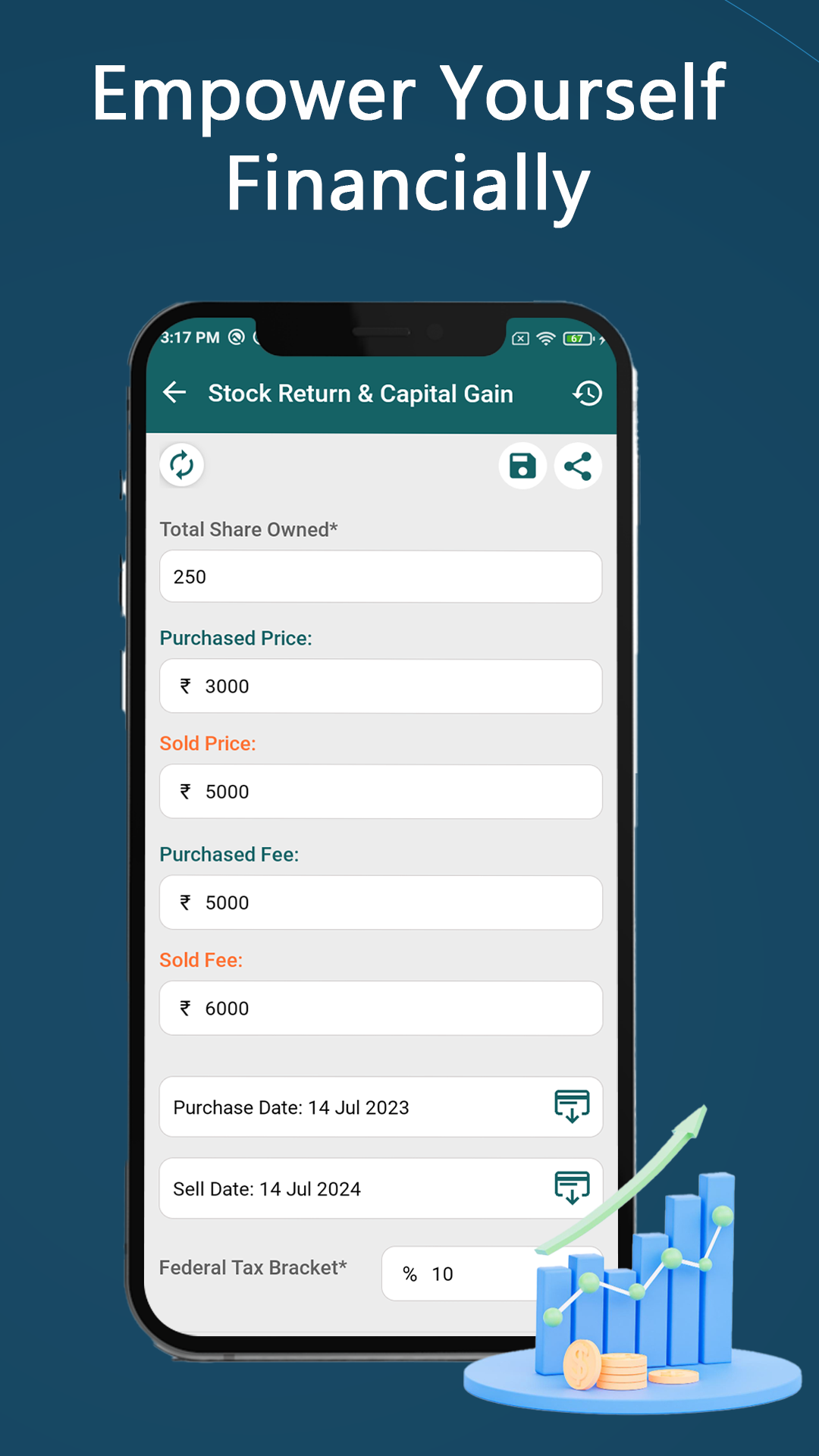

- Investment analysis: The calculation of the return on investment (ROI) for investment, as well as the risk associated with the investment.

In addition to these basic financial calculations, many financial calculator apps also offer a variety of other features, such as:

- Real-time currency exchange rates: This allows you to calculate the value of your investments in different currencies.

- Saving and sharing of calculations: This allows you to save your calculations for future reference and to share them with others.

- Educational resources: Many financial calculator apps include educational resources, such as articles and videos, to help you learn more about financial concepts.

Related Apps + Games

View All-

VarnaLove

by VarnaLove

-

Photo Collage - Free Pic Frame Maker, Grid Creator

by Way4Apps

-

The Lost Signal: SCP-1499

by Wing13 Games

-

SLOPE 3D

by ADDPGAMES