Description

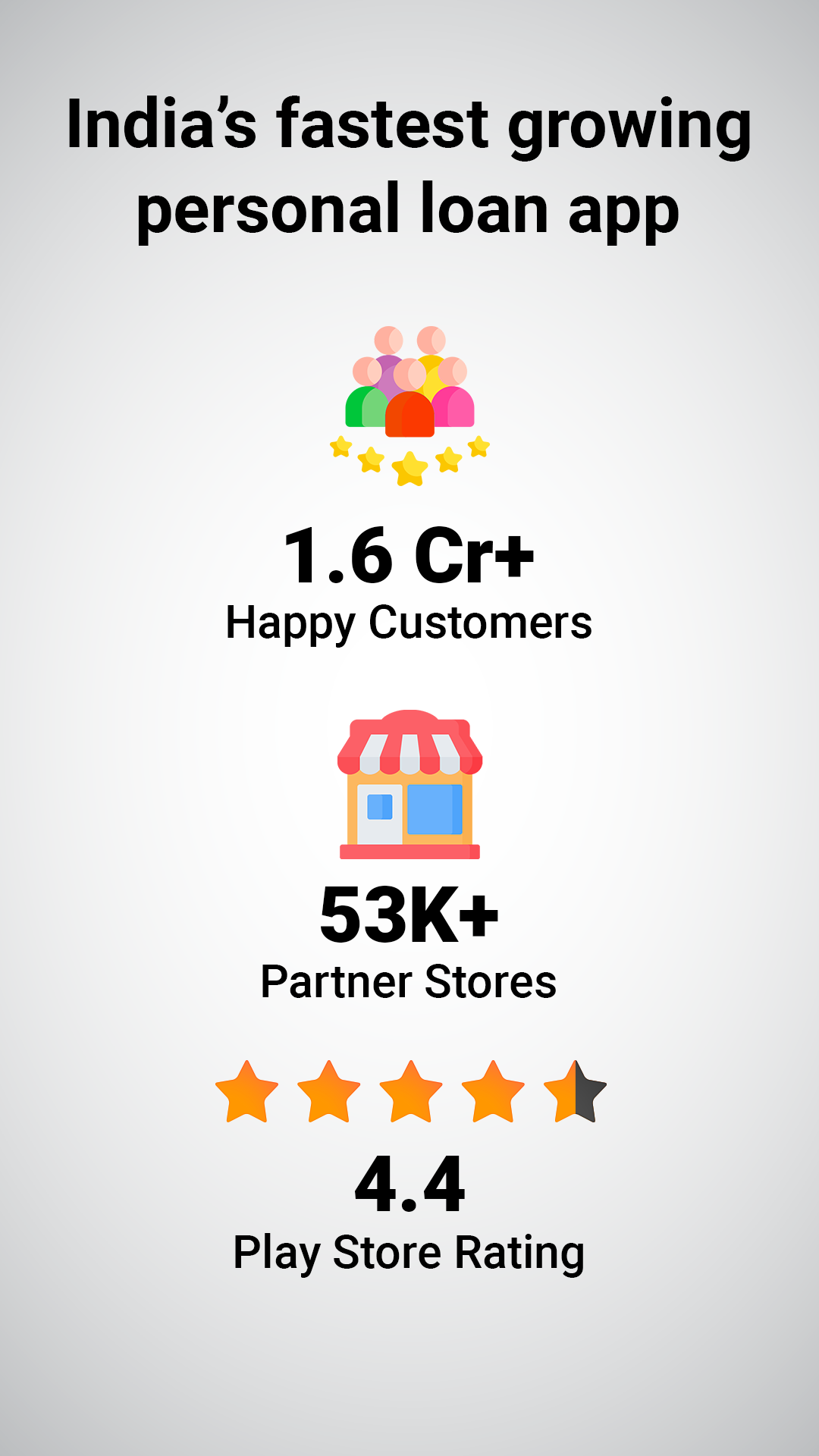

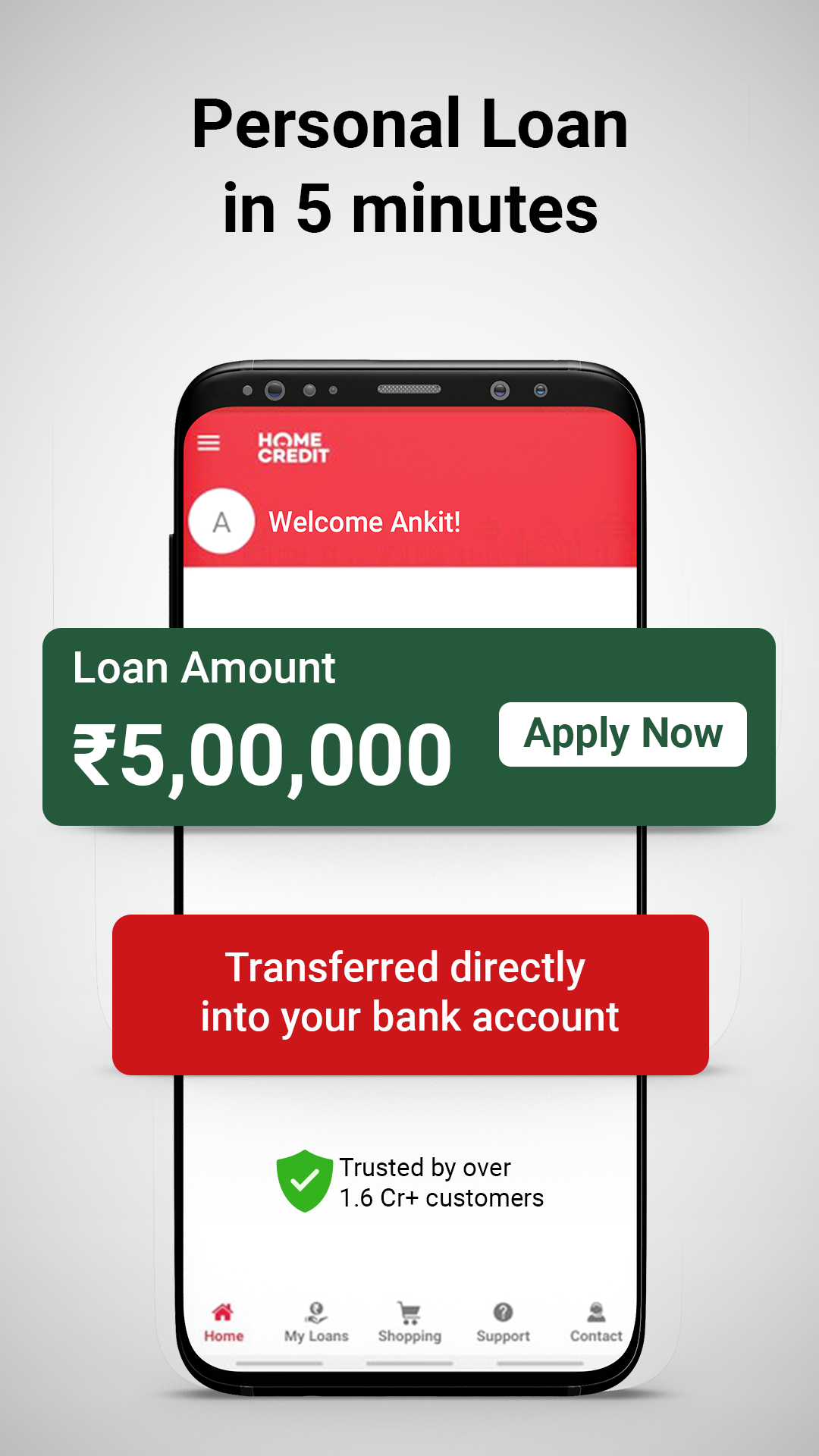

Home Credit is one of India's fastest-growing personal loan apps, trusted by over 1.6 Crore+ happy customers. With instant approval, quick disbursal & 100% online application process, we offer hassle-free personal loans of up to ₹5,00,000 for all your needs.

✨Explore the features & benefits of our personal loan app:

✅Instant Loan Approval - Get your personal loan approved within just 5 minutes on our user-friendly loan app.

✅Quick Disbursal - Once approved, your loan gets disbursed directly to your bank account, ensuring swift access to funds.

✅Trusted Loan App - Home Credit is a trusted RBI-registered NBFC, serving millions of happy customers.

✅Minimal Documentation - Apply for a cash loan with just 2 documents, i.e., your PAN card & an address proof.

✅100% Safe & Secure - Enjoy complete transparency & security with no hidden charges, ensuring a worry-free borrowing experience.

✅Flexible Repayment Options - Repay your loan EMIs conveniently with our multiple repayment methods, tailored to suit your financial needs.

✅Personalized Loan Solutions - Instant loan to cater to all your financial needs such as medical emergencies, home renovation, higher studies, travel, or wedding expenses.

✨Why Choose Home Credit Personal Loan App?

✔User -Friendly

✔Trusted by Over 1.6 Cr happy customers

✔4.4-star rating on Google Play Store

📋How to Apply for an Instant Personal Loan?

👉Download the Home Credit personal loan app.

👉Submit your details and complete registration process.

👉Upload your KYC documents.

👉Enjoy instant approval & get funds disbursed directly to your bank account.

📋Eligibility Criteria for Home Credit Personal Loan:

✔Should be an Indian citizen.

✔Age requirements: 18 - 60 years

✔Should be a salaried, pensioner, or self-employed individual.

📋Documents Required to Apply for Instant Personal Loan:

✅PAN Card & address proof.

✨In addition to our personal loan offerings, Home Credit India introduces the Ujjwal EMI Card, a unique financial tool designed to enhance your shopping experience, both online & offline.

✨Ujjwal EMI Card Features:

☑️Enjoy online & offline shopping on easy EMIs

☑️Instant Pre-approved limit of up to ₹75,000

☑️No-Cost EMI options on the Home Credit Personal Loan App.

☑️Payment modes include auto debit, UPI, net banking, & debit cards.

☑️Experience a 100% digital loan process with our app.

Home Credit is a one-stop solution to all your financial needs. Our personal loan app helps you to get easy access to money with an instant loan of up to ₹5,00,000 to cover all your expenses with ease. Enjoy the benefit of Home Credit’s financial services from the benefit of your home.

✔Loan Amount: Up to ₹5,00,000

✔Minimum Annual Percentage Rate (APR): 19.5%

✔Minimum repayment period: 6 months

✔If you opt for a Value-Added Service, the fee for the same shall be levied additionally

✔ If you opt for Safe Pay Services, you get benefits like Payment Holiday, Free Early Repayment, Life Insurance & Health Services with your loan.

Representative Example:

Loan Amount: ₹70,000

Tenure: 24 months

Interest Rate: 32%*

EMI: ₹3986/month

Processing Fees: ₹2,730*

Total Amount Payable: ₹95,672

*The annual interest rates & processing fees will vary as per the risk profile of the customer.

Maximum APR can go up to 48% (However, only a fraction of our customers gets an interest rate higher than 30% per annum). These numbers are indicative & subject to change.

At Home Credit, we ensure absolute safety of our customers using world class security & privacy standards to protect their data, ensuring a safe borrowing experience. All information requested from Home Credit is only used to generate the best offers for you.

Contact Us:

📧Email: care@homecredit.co.in

📱Call: +91-1246628888 (Between 9:00 AM - 6:00 PM, All Days)

🌐Website: https://www.homecredit.co.in/contact-us

🏢Address: Home Credit India Finance Private Limited, DLF Infinity Towers, Tower C, 3rd Floor, DLF Cyber City Phase II, Gurugram-122002, India

Related Apps + Games

View All-

Red Carpet Celeb Quiz

by Cem Ozmen

-

Women Lehenga Choli Suits

by ATM Apps

-

Mountain Water Live Wallpaper

by ram

-

CM SECURITY ANTIVIRUS PLUS

by RED ANDRO SOLUTIONS